A Clear Path To Home Financing

Support from preapproval to closing

The home loan process can feel overwhelming—but it doesn’t have to. When you partner with a trusted lender and stay informed at each step, from pre-approval to closing, the experience becomes far more manageable and stress-free. I’m always happy to recommend a few lenders I’ve worked with and trust, while fully supporting your choice to work with any lender you prefer. The goal is simple: ensuring you feel confident, informed, and well cared for throughout the process.

Estimate Your Monthly Payment

Estimate your mortgage payment, including the principal and interest, taxes, insurance, HOA, and Private Mortgage Insurance.

Price

Annual Tax

Loan Term (Years)

Down Payment %

Interest Rate %

Monthly HOA

Monthly Insurance

$3,198.20

Estimated Monthly Payment

Principal

$2,398.20

(75.0%)Taxes

$500.00

(15.6%)Private Mortgage Insurance (PMI)

$0.00

(0.0%)HOA

$100.00

(3.1%)Insurance

$200.00

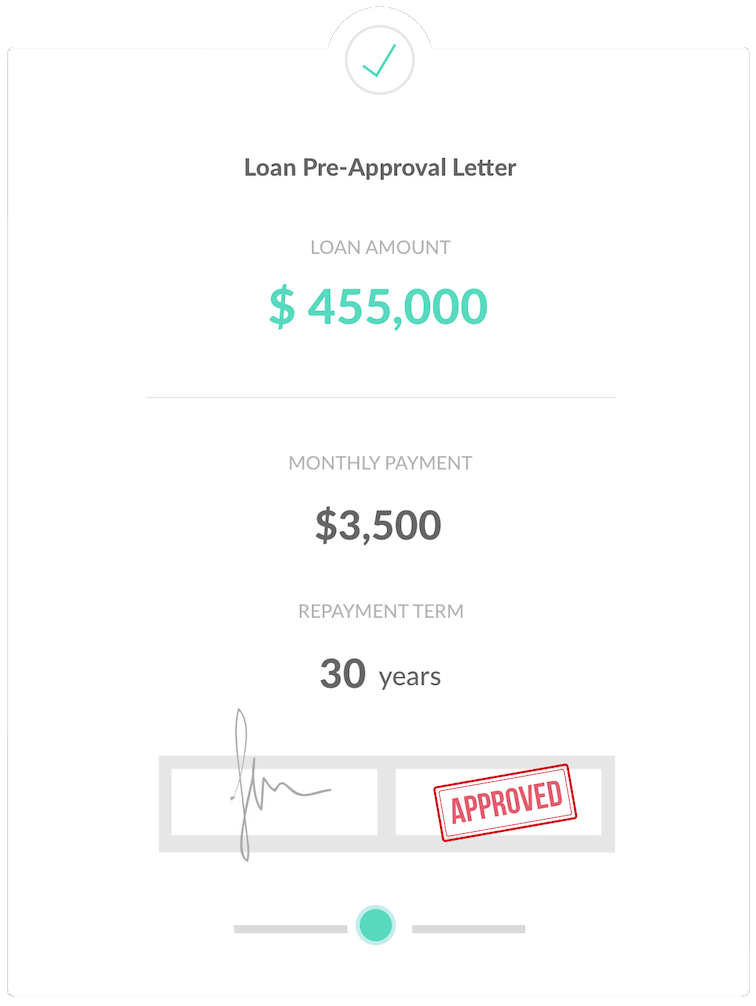

(6.3%)Step One:

Get A Pre-Approval Letter

Before you start looking for a home to buy, it’s wise and proactive to speak with a lender to get pre-approved for a loan amount. Offers accompanied by a pre-approval letter are stronger and will stand out, especially if the seller is receiving multiple offers.

The preapproval process may seem daunting but it truly is a simple and quick process, taking anywhere from a couple of minutes up to 1-2 days.

To gain pre-approval, your preferred lender will gather information about income, assets, and debts to help determine how much you can borrow. This includes gathering a credit report, W-2 forms, pay stubs, federal tax returns, and recent bank statements.

There are a variety of home loan programs offering different advantages depending on your unique needs and preferences. Your preferred lender can go over the specifics of each to ensure you find a loan option that best aligns with your needs.

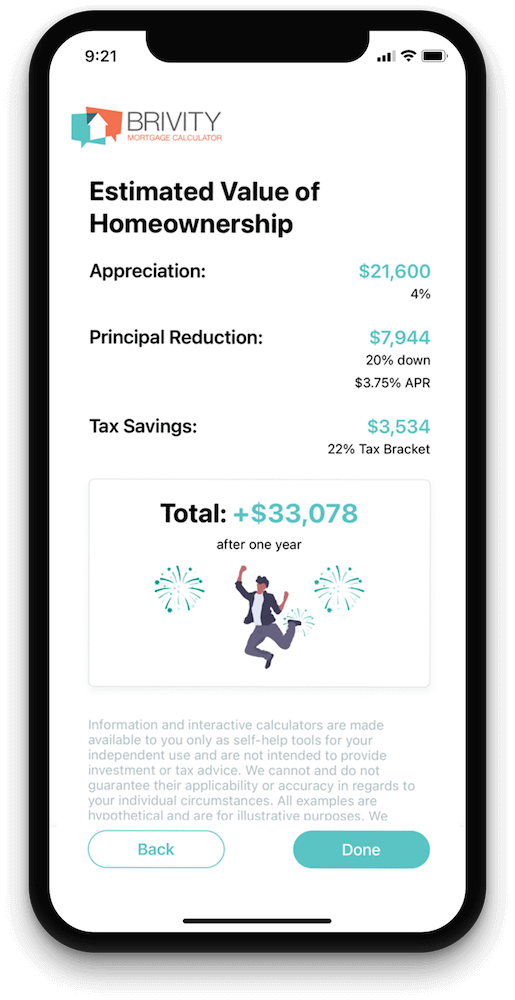

Step Two:

Find the best loan for you

Collaborating with a top-notch local loan officer will ensure you have access to competitive rates and programs that best fit your individual needs. Take the first step by completing this form to get connected today!

Step Three:

Next Steps After Going Under Contract

Once you’ve found the right home and your offer is accepted, your lender will guide you through completing a full mortgage application, reviewing down payment options, and understanding any associated fees.

Your application then moves into processing, where supporting documents are carefully reviewed. During this stage, the lender will also order a home appraisal and a property title search.

Next, the loan package is submitted to underwriting for a comprehensive review to ensure it meets all lending and compliance requirements.

It’s common to receive requests for additional documentation or clarification during this phase—this is a normal part of the process and helps keep your loan moving forward toward approval.

Step Four:

Ready for the keys

Your documents will be sent to the title company, and a closing date will be scheduled for you to review and sign the final paperwork. You can expect the actual closing to take 30 minutes to an hour.

At closing, you’ll sign the final closing documents and pay any outstanding costs needed to complete the purchase—then it’s time to celebrate, because your new home is officially yours.